Top 17 AI Stock Trading Software In 2024

You can simplify your investment and research procedures with AI stock trading software. Some systems offer predictions and insights supported by AI, while others provide automated trading services.

The field of stock trading is being revolutionized by artificial intelligence (AI), which uses computing power to do out activities that highly advanced human logic and knowledge replication. Because AI and ML use automated procedures and rules that remove computational human error and reduce the need for humans to spend hours performing activities, they result in fewer mistakes.

The Role of AI in Stock Trading

Artificial intelligence (AI) has the potential to transform the trading industry completely by enhancing the effectiveness and precision of financial decision-making. AI algorithms may analyze large volumes of data in real-time, which can then be used to spot trends and make trading decisions.

This can potentially boost profits, lower the chance of human mistakes, and assist traders in making better-informed selections.

Let’s look at the top 17 AI stock trading software available, as there are a lot of excellent solutions available:

Top 17 AI Stock Trading Software for 2024

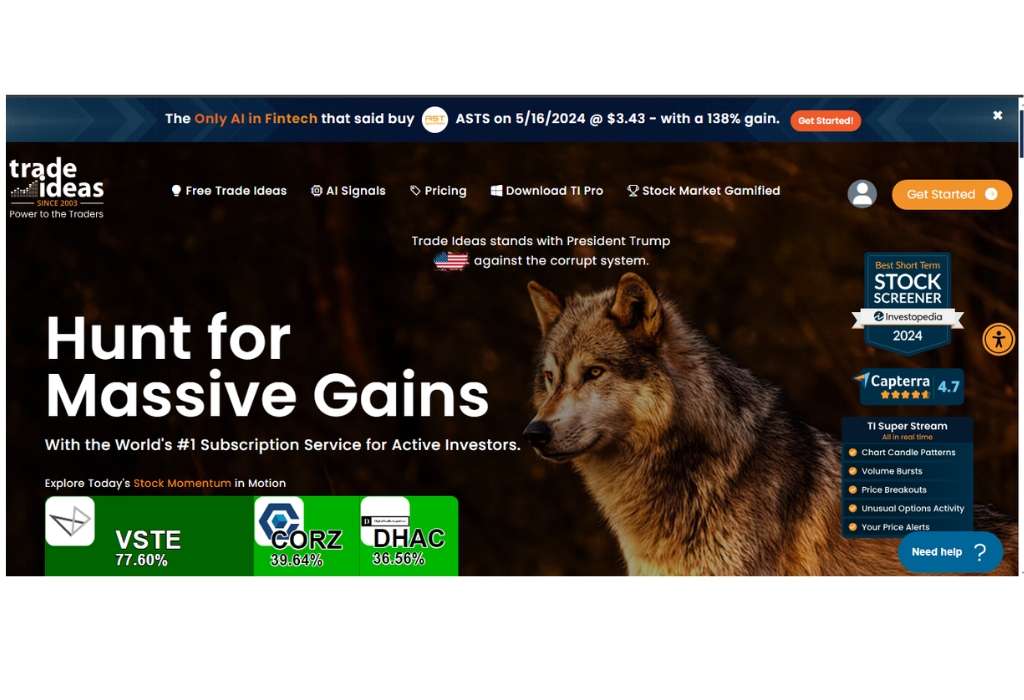

1. Trade Ideas

With the use of Trade Ideas, traders and portfolio managers may make more informed judgments in the stock market thanks to artificial intelligence. Trade Ideas finds possibilities to get ahead of the competition in markets and industries where no one else is searching.

Trade Ideas’ artificial intelligence capability, HOLLY, processes enormous amounts of structured and unstructured data (news, social media, market activity, etc.) on all US equities overnight using about 40 different trading strategies, each with multiple algorithms that collectively account for tens of millions of simulated trades.

As a result, the reports indicate 5-7 trade situations that could outperform the market every trading day. Every strategy has risk boundaries placed against it, so traders are aware when upper or lower bounds are reached.

2. Tickeron

Tickeron’s AI scanners offer an in-depth examination of prospective opportunities. Their trend prediction engine can predict rallies before they happen. Additionally, they assigned it a Likeliness rating. Our review of Tickeron revealed their dependability.

This extensive trading platform comprises more than just the scanner. The amount of time saved by using the offered research and analysis tools can be substituted for the hours spent looking at data yourself. Live data is used by Tickeron. You’ll be able to make more precise trading judgments as a result. Additionally, it has a tonne of preset screens configured.

3. Alpaca

Scanners are just one part of this extensive trading platform. The research and analysis tools provided can replace the hours spent looking at data. Tickeron utilizes actual data. You will therefore be able to make more precise trading judgments. It has a tonne of preset screens configured as well.

Using the REST (pull) or streaming (push) API, your trading algorithm can obtain real-time pricing and fundamentals, place orders, and manage your portfolio.

4. QuantConnect

With the browser-based algorithmic trading software QuantConnect, you can create, test, and implement strategies. They support equities, futures, options, forex, CFDs, and cryptocurrencies. They also provide terabytes of free financial data and enable live trading (including paper trading) and strategy backtesting using their own data or data from several top brokerages.

The platform’s goal is to provide a convenient and comprehensive solution. You can start from scratch and develop fully tested and verified strategies.

5. Kavout

The goal of the Kavout platform is to use AI technology to improve investment methods. It helps customers find profitable investment ideas by providing them with a powerful AI research assistant.

It guides users through the intricacies of investing, accommodating both inexperienced and seasoned investors, and promotes making wise decisions by leveraging cutting-edge technology and data-driven insights.

6. Kensho

Kensho offers a dual consumer value proposition. Kensho’s vast data sources are utilized in the first. The Knowledge Graph restructures this data into a graph-based design, enabling rapid and effective insights. The Kensho Global Event Database continuously absorbs and compiles data on the world’s markets.

Kensho’s CVP’s second key element is a machine learning-powered analytics platform that provides clients with data analysis and visualization services. Kensho provides its clients with even more value because of the synergy between the two offerings.

7. AlphaSense

The top financial institutions and businesses worldwide use AlphaSense, a market intelligence and search platform. Since 2011, professionals have benefited from our AI-powered technology, which delivers insights from a vast array of public and private content, including company filings, expert call transcripts, event transcripts, news, trade journals, and stock research.

This technology has helped professionals make more informed business decisions. More than 4,000 enterprise clients—many in the S&P 500—trust our platform.

8. Numerai

Without a doubt, people will remember 2023 as the year of AI. As ChatGPT‘s user base grew, prominent figures in the computer industry—like Bill Gates—acknowledged the revolutionary potential of AI and compared it to the introduction of the internet.

The shares of US company BuzzFeed shot up 300% after its CEO made a simple comment about integrating AI into its main business. Businesses that had even a passing connection to AI saw significant growth. AI rules this period.

9. EquBot

For institutional investors, EquBot is a cutting-edge investing platform driven by IBM Watson. Portfolios as a Service (PaaS) assists them in making more informed investment decisions. EquBot has index and ETF assets that offer a variety of investment options. Using Watson’s cutting-edge AI technology, investors may take advantage of unparalleled accuracy and precision in their trading plans.

The distinctive feature of EquBot is its capacity to use AI technology to instantly analyze massive volumes of data, giving investors insightful information and facilitating easier and more educated investment decisions. Become one of the elite organizations that already trust EquBot to make investment decisions: Arlington Asset Investment. See the IBM website for further information.

10. Tradervue

Tradervue is an all-inclusive web application designed to help traders automate their journaling and analytical procedures. It serves as a trading journal for stocks, futures, and currencies as well as a handy platform for learning and keeping personal records. Tradervue gives traders the tools they need to assess their performance, make better decisions, and eventually up their trading game.

These tools include comprehensive recording, sophisticated analytics, and community-sharing capabilities.

11. ArbitrageScanner

A revolutionary artificial intelligence trading tool called ArbitrageScanner helps traders take advantage of price discrepancies between exchanges and profit handsomely from them. The trading program keeps track of over 60 CEX and DEX, enabling it to provide users with immediate updates on the best times to purchase and sell Bitcoin assets. Its creative AI infrastructures make this possible.

12. TrendSpider

With its proprietary machine learning algorithm and stock market platform, TrendSpider offers sophisticated automated technical analysis. All investors, including day traders, are the target audience for the stock analysis program.

To identify patterns in the forex market, TrendSpider’s in-house algorithm looks through past market data. Once the algorithm identifies these patterns, it forwards the data to human traders, who use it to execute profitable and successful transactions.

With regard to TrendSpider Trading Bots, they may assist you in transforming your approach into a position-aware, completely automated bot capable of performing almost any work. Before deploying your approach as a Trading Bot, you use the platform’s approach Tester to refine and polish it.

13. Interactive Brokers

Aggressive traders like Interactive Brokers because of its cheap share pricing, advanced trading interface, extensive selection of tradable assets, including foreign shares, and ridiculously low margin requirements. IBKR Lite, its entry-level product, offers commission-free stock and ETF trading.

Although IBKR Lite, a second tier of service intended for more casual users, was introduced by Interactive Brokers in 2019, the company has long been a well-liked broker for experienced traders. You can trade stocks and ETFs listed on U.S. exchanges for free, without limits, with IBKR Lite.

14. NinjaTrader

As a one-stop shop for futures trading, NinjaTrader brings together all the resources required for novice and expert traders to participate in the world’s futures marketplaces.

Set off on your trading adventure armed with effective instruments and the 24/7 assistance you require, such as:

- Expert systems for futures trading to generate charts

- Current brokerage firms for futures that offer free trading simulation

- A wealth of assistance resources, such as free premium trade education tools and real-time chat

15. Perceptrader AI

With Perceptrader AI, a cutting-edge trading bot, FX traders can increase their profits by utilizing artificial intelligence’s power. The trading bot is becoming very popular because of its unique characteristics and outstanding performance.

To analyse market projections and signals, Perceptrader AI includes cutting-edge technologies like as ChatGPT and Bard. For certain currency pairs, the trading bot can use ChatGPT to forecast market size and offer insights into recent market data.

16. eToro

With ten locations across the globe, including ones in the US, UK, Israel, Cyprus, and Australia, eToro is a multi-asset brokerage and social investment firm.

eToro offers a large range of equities, currencies, commodities, ETFs, crypto assets, and indexes for manual investing via its proprietary cutting-edge investment platform. Our clients can invest in a range of financial instruments and track them with the help of eToro’s expert tools and analyses.

Through social investing, our clients can monitor the financial activities of other clients and copy their actions in real time using our CopyTraderTM system. The eToro platform functions in complete transparency to facilitate this process, showing each client’s pertinent information, including gain %, risk score, and portfolio composition.

17. Blackboxstocks

Blackboxstocks, Inc. is a hybrid platform that combines financial technology and social media, providing stock and options traders of all skill levels with real-time proprietary analytics and news. Our artificial intelligence-enhanced “predictive technology” is used by our web-based software to identify volatility and unexpected market activity that could cause a stock or option’s price to fluctuate quickly.

Blackbox analyses approximately 10,000 equities and up to 1,500,000 options contracts many times per second as it continuously searches the NASDAQ, New York Stock Exchange, CBOE, and all other options exchanges.

How to Choose the Right AI Stock Trading Software

We go over the factors you should take into account when selecting an AI trading platform in this part.

Features

Robocopy that performs well should be able to provide historical, present, and future event data. Your preferences, trade techniques, and objectives should be reflected in the features and tools.

Pricing

Make sure the AI trading platform provides good value for the money. Carefully consider if you can afford to buy or subscribe to an AI system if you feel compelled to.

Performance

It’s not a bad idea to experiment with new trading bots, but it’s a dangerous endeavor that could result in gains or losses. Seek for artificial intelligence software that has been tried and true and has a track record of producing steady yet profitable returns in a variety of market conditions.

Brokerage Services

Brokerage services are not provided by the majority of AI trading sites. This implies that a compatible broker must be connected to the platform. The AI program won’t be able to access the financial markets otherwise.

Conclusion

Artificial Intelligence is here to stay, no doubt, and it’s time you incorporated its technology into your trading endeavours. Artificial Intelligence is a great tool that traders may use to manage their portfolios efficiently and find the most profitable chances. Our ranking of the top AI trading software for locating and executing deals with large profit margins places Trade Ideas at the top.